Top 5 tips for Marketers preparing for the HFSS Regulations (plus one bonus tip)

Top tips to prepare for the HFSS Regs

New regulations surrounding the marketing of High Fat, Sugar & Salt (HFSS) products come into force in October of this year. The rationale behind the public health initiative is to reduce the consumption of foods that contain High Fat, Sugar & salt , particularly by younger consumers. As well as restrictions on advertising, the regulations will also target in-store advertising and merchandising, in a move which is likely to have an impact on existing sales patterns, particularly impulse purchasing. BASE’s data, across a number of clients has shown that Shopper Marketing within HFSS can increase sales uplifts in the Desserts category by 39%, Confectionery and biscuits by 28% and Soft Drinks by 23% with many of these activations also increasing brand awareness and delivering a positive return on investment.

Nick Widdowson, shopper marketing and psychology consultant comments, ‘The Consumer Packaged Goods (CPG) sector has had a lot of challenges to deal with - recovery from a global pandemic, a supply crisis, major conflict in Europe, soaring living costs and 30-year-high inflation, record fuel and food prices and the largest decline in consumer confidence in a generation; so the timing of the HFSS legislation has presented challenges to CPG companies in terms of preparation.”

Some retailers are already making changes to their estates, particularly around promotional fixtures. Even ‘symbol groups’ may be affected if an individual store is over 2000 sq ft. So if you’re involved in shopper marketing, what implications do these changes have for you and how can you address them?

Not a level playing field

The changes are unlikely to affect all CPG suppliers equally. If the balance of your portfolio lies in HFSS categories, then it’s inevitable that you’re going to face some severe challenges; on the other hand, if your products are unaffected, then you may find that your promotional budgets will stretch a little further if the large manufacturers divert their promotional budgets to other marketing initiatives, not in the scope of these changes. The laundry products marketers are probably rubbing their hands with glee at the prospect of HFSS brands being reduced. Ironically, it could also mean that food & beverage products that are not even classed as ‘healthy’, such as alcohol, could find themselves able to grab more store real estate; out with pallets of chocolates at the store entrance at Christmas and in with crates of beer & lager.

Even if CPG suppliers rely on shelf-sales, rather than FSUs and gondola-end promotions, it is likely that the larger brands, with a higher customer-recall will take a larger share of the market, even if overall sales are down. They may also have more power to leverage ‘power aisles’, with smaller brands having to fight even harder for share of shelf.

Top 5 things HFSS marketers and shopper marketers can do

As with any threat, there is usually an opportunity, so what can HFSS shopper marketers do to try and mitigate lost sales? As the saying goes, ‘Failing to plan is planning to fail’.

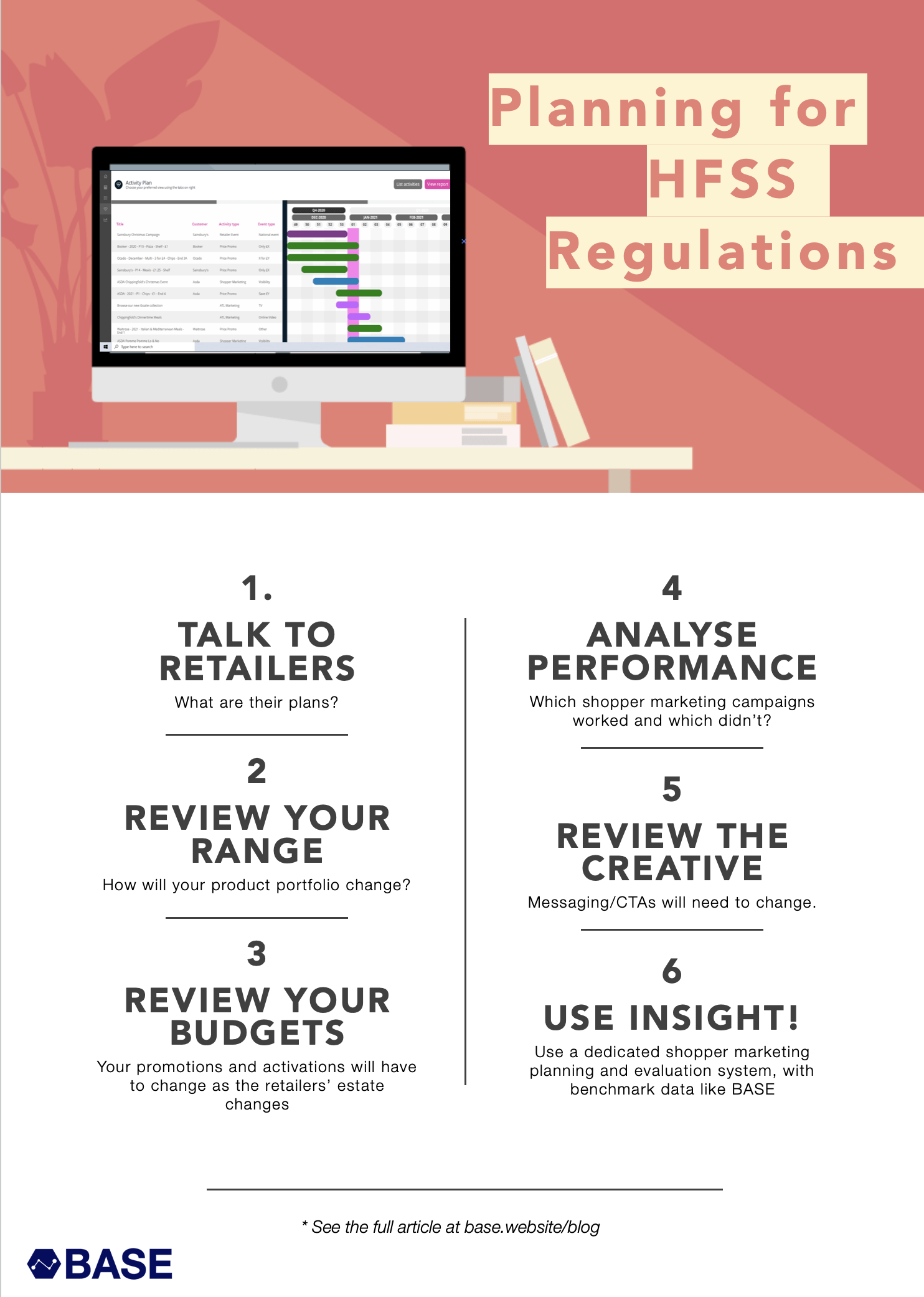

1. Talk NOW to impacted retailers

- the changes are going to impact them, just as much as they are you. Discuss what opportunities they are putting in place to support brands, whilst remaining compliant with the regulations. Will they be increasing mid-aisle category features and what impact will that have on SKU levels?

2. Review your range

- Will there be a move towards larger packs, rather than multi-pack buys? The supermarkets have been undergoing range rationalisation for years and this will increase. They will be allocating more shelf-space for healthy foods. Will you be considering range rationalisation. The more you can be fully-prepared on how the regs will impact your brand(s), the more productive your trading arrangements with the retailer(s) will be.

3. Review your budgets

- you will most likely need to reallocate your shopper marketing budget with a huge cut in mechanisms such as gondola-end promotions, pallet displays and BOGOF type promotions. Consider activities such as shelf-barkers, mid-aisle floor/ceiling adverts. Re-evaluate the type of cost promotions you offer, for example re-directing incentives designed around increasing consumption, such as multi-buys towards EDLP promotions.

4. Analyse your historical performance

- although ‘ceteris paribus’ won’t strictly apply, past performance of campaigns may provide an insight into customer motivations and purchase patterns. Will the fact that treats are harder to find mean that determined customers, seeking their favourite brands will be prepared to hunt a little harder? How can you signpost them to your products?

5. Review the creative - collaborate with other members of the brand, digital, marketing, account management and field-sales teams to ensure your multi-channel marketing campaigns are consistent. With impulse purchasing largely being removed, it’s more important than ever that existing and new customers are being guided through the AIDA (Awareness, Interest, Desire, Action) process to pick your product from the shelf and into their basket. The power of ‘visual disruption’ will be more important than ever.

Plus a bonus tip:

6. Use a dedicated system to plan and gain deeper insight - shopper marketing systems allow you to plan and measure your campaigns. Systems like BASE even offer complementary support such as benchmarking and sophisticated evaluation metrics to truly help you understand the ROI on campaigns and activations, so that you can do more of what does work and spend less on resource-sapping activities.

What changes are you making to address the regulations?